Operating Ratio: Definition and Formula for Calculation

A low ratio compared to industry averages indicates an inefficient use of business assets. Operating ratio is used to determine the efficiency of the management with which it is possible to generate a certain level of sales or revenue. It also helps in establishing how the company’s management is instrumental in reducing costs. The net margin considers the net profits generated from all segments of a business, accounting for all costs and accounting items incurred, including taxes and depreciation. It comes as close as possible to summing up in a single figure how effectively the managers are running a business. Highly variable operating margins are a prime indicator of business risk.

Operating Ratio vs. Operating Expense Ratio

It is based on historical data and does not factor in future performance. The operating Ratio only tells you what happened in the past fiscal year. It does not provide any insights into what might happen in the next year or future years. A corporation is likely to artificially boost its operating Ratio in the near run even if its spending reductions are unsustainable if they occur in a single year. Investors need to supplement the operating Ratio with other forward-looking analyses to get a better sense of a company’s earnings potential. A higher ratio would indicate that expenses are more than the company’s ability to generate sufficient revenue and may be considered inefficient.

Financial Calculations That Reveal Your Business’s Health

- If the company was able to negotiate better prices with its suppliers, reducing its COGS to $500,000, then it would see an improvement in its operating margin to 50%.

- Operating ratio is an important financial metric used to evaluate the efficiency and profitability of a company.

- This Ratio allows the business to deliver strong returns to shareholders while positioning itself for long-term success.

- The current ratio is current assets (assets that can be converted to cash within a year) divided by current liabilities (debts that need to be repaid within a year).

- Investors must dig deeper to understand inflections in the operating ratio trendline.

- The operating margin can improve through better management controls, more efficient use of resources, improved pricing, and more effective marketing.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

For more finance tips

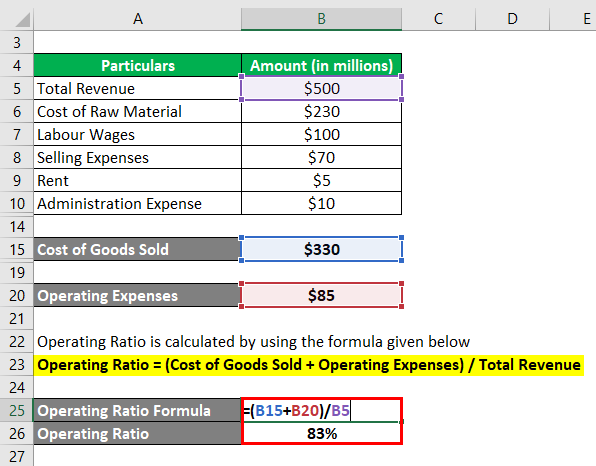

An operating ratio that is decreasing is viewed as a positive sign, as it indicates that operating expenses are becoming an increasingly smaller percentage of net sales. The following steps are to be undertaken to calculate the operating ratio in case the operating expenses include the cost of goods sold. Operations-intensive businesses such as transportation, which may have to deal with fluctuating fuel prices, drivers’ perks and retention, and vehicle maintenance, usually have lower profit margins. The operating margin should only be used to compare companies that operate in the same industry and, ideally, have similar business models and annual sales.

Improving operating ratios combined with stable or increasing ROIC indicates management is deploying capital in value-creating investments. Meanwhile, an increasing operating ratio alongside falling ROIC suggests wasteful capex or dysfunctional execution. The operating Ratio focuses purely on operations and does not take into account how the company finances itself or the mix of assets it requires.

Why Is Operating Margin Important?

The goal is to surface companies with metrics suggesting upside potential. As with any financial metric, it is important to consider the operating ratio in conjunction with other indicators and conduct a comprehensive analysis before drawing any conclusions. However, by understanding and utilizing the operating ratio, you can gain valuable insights into a company’s financial health and make informed decisions. Maintaining a lower operating ratio is a good way to achieve operational efficiency. It is especially useful in a mature business, where a key focus of management is maintaining control over expenditures.

Consequently, it is necessary to drill down well below the level of each ratio to determine the nature of a problem, and how to correct it. Analysts sometimes use the operating Ratio to enhance fundamental analysis in the following ways when assessing stock market investing possibilities. This would indicate that a company’s operating expenses exceed its net sales revenue, resulting in operating losses and poor efficiency in the stock market. By tracking operating expenses as a percentage of revenue, operating ratios provide a sense of how efficiently a company is running its business. Declining operating ratios indicate improving efficiency, while increases suggest inefficiencies or waste. Comparing operating ratios to industry benchmarks also measures efficiency relative to peers.

Companies have some leeway in classifying costs as operating expenses or not. For example, a company could classify a major R&D project as a capital expenditure rather than an operating expense, which would lower its which transactions affect retained earnings. Classification decisions like this make comparisons between companies difficult if they treat similar expenses differently. The subjectivity involved means investors should be wary of any suspicious one-time improvements in a company’s operating Ratio. Investors should consider operational ratio trends over time as opposed to absolute values at a certain moment in time when comparing firms.

Initially, start-up companies may make losses until they establish themselves. For example, software or gaming companies may invest initially while developing a particular software/game and cash in big later by simply selling millions of copies with very few expenses. An extremely high operating margin is of little value if it comes at the expense of quality.

Revenue ratio, also known as sales to total assets ratio, refers to the amount of money earned by a company through its operations expressed in percentage terms. Expressed as a percentage, the operating margin shows how much earnings from operations is generated from every $1 in sales after accounting for the direct costs involved in earning those revenues. Larger margins mean that more of every dollar in sales is kept as profit. Segment the operating Ratio into its key components like the cost of goods sold, selling & administrative expenses, depreciation, etc. Analyze each line item over time and vs. peers to pinpoint what specific expenses are driving changes in the overall Ratio. This uncovers whether rising costs are tied to factors like input costs, labor, excess capacity, or other factors, providing color into the root causes behind improving or deteriorating operational leverage.

It’s also important to compare the operating ratio with other firms in the same industry. If a company has a higher operating ratio than its peer average, it may indicate inefficiency and vice versa. Finally, as with all ratios, it should be used as part of a full ratio analysis, rather than in isolation.