Stock Trading: What You Need to Know to Get Started

Contents:

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Investing is the act of committing money or capital to an endeavor with the expectation of obtaining additional income or profit. Chad Langager is a co-founder of Second Summit Ventures. He started as an intern at Investopedia.com, eventually leaving for the startup scene.

Stocks close higher, snap 2-day losing streak as Wall Street shakes off Fed minutes – CNBC

Stocks close higher, snap 2-day losing streak as Wall Street shakes off Fed minutes.

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

The forex market is the largest financial market globally, with the highest amount of capital invested and traded daily…. You can’t learn everything you need to know at once – trading is a long-term journey. What you can do, though, is give yourself the best possible start by building the right foundations and begin acquiring valuable knowledge at the outset. Day trading is a stressful, risky approach to stock trading.

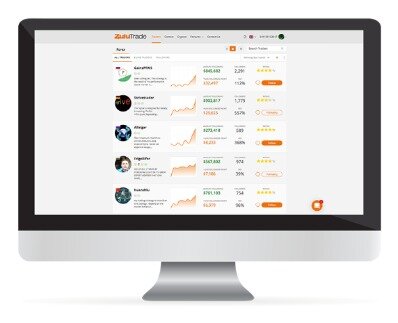

Optimize your stock portfolio

Seminars and classes can provide valuable insight into the overall market and specific investment types. This is an age of free content, so I’d need a mountain of evidence and recommendations from people I trust before I shell out my hard earned cheddar. Will O’Neil workshops, Dan Zanger and Mark Minervini, which I have attended. You name your price, and the buy only gets executed if the stock falls to that price or lower within a selected time period. If the stock never reaches the specified price before the limit order expires, your trade gets canceled. You will need a broker to make trades, so you’ll want to find one that you like and trust.

And now, it’s been almost totally replaced by computers. The STT blog is filled with explainers on everything from the basics to technical analysis. I want you to watch this video and think about something super trader Roland Wolf says. There are a lot of reasons for this, not all of them good. People are staying home and getting bored — which is never a good reason to trade.

What Is the Difference Between a Full-Service and a Discount Broker?

Cut losses early and avoid the emotional or psychological urge to take on ever greater risk in hopes of breaking even. Traders need to coexist peacefully with the twin emotions of greed and fear. Paper trading doesn’t engage these emotions, which can only be experienced through actual profit and loss. In fact, this psychological aspect forces more first-year players out of the game than bad decision-making. Your baby steps forward as a new trader need to recognize this challenge and address remaining issues with money and self-worth. So, when do you make the switch and start trading with real money?

For example, day trading can be expensive since you are trading frequently. Furthermore, since your trades are less than a year in duration, any https://day-trading.info/ profits are subject toshort-term capital gains taxes. Almost all of today’s most successful investors had mentors when they first got started.

Read articles and listen to podcasts

If you want to learn day trading and you’re a beginner, penny stocks can be a good place to start. But if you want to learn how to invest in stocks, and you’re a beginner with only a little money — stay away from penny stocks. Study the basics oftechnical analysisand look at price charts—thousands of them—in all time frames. Do not stop reading company spreadsheets, because they offer a trading edge over those who ignore them.

Lastly, stop-loss orders are combined with a market or limit to trigger once $X price hits. For investors just getting started, I always suggest sticking with market orders. Once you’ve opened and funded a brokerage account and then identified stocks you’d like to buy, it’s time to execute trades in your account. Before you put in an order to buy stock, you need to understand a few details about the process—purchasing stock isn’t as simple as just pressing a buy button on an app. You’ll generally have to pick an order type, which provides instructions on how you want to purchase a stock.

- If so, you have a potential entry point for a strategy.

- They try to make a few bucks in the next few minutes, hours or days based on daily price swings.

- A request to buy or sell a stock only at a specific price or better.

- Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets.

- Limit orders only buy or sell these shares at, “$X price or better”.

You’ll find a community of motivated traders happy to share strategies. There’s no secret, no magic trade that’s gonna turn you into a millionaire. list of all personality traits, ideals, bonds & flaws Forex training, broadly, is a guide for retail forex traders, offering them insight into successful strategies, signals and systems.

Full-Service Brokerages

Ratchet down that 10% if you don’t yet have a healthy emergency fund and 10% to 15% of your income funneled into a retirement account. When it comes to strategies, you’ll need to find what works best for you. Although that might sound like a cop out, you’ll hear time and time again that one strategy works for one person but not another. There’s no holy grail, and there’s no magic indicator that results in endless profits.

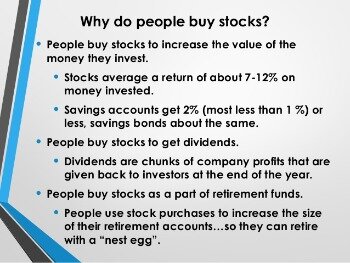

One way to think about researching the stocks you want to buy is to adopt a well-thought out strategy, like buying growth stocks or buying a portfolio of dividend stocks. The thing about robo-investors, though, is that you’re not buying stocks directly—you’re buying a portfolio of ETFs. Some of those funds will almost certainly be stock ETFs, like the SPDR S&P 500 ETF Trust , which strives to match the performance of the S&P 500 stock index. But others could be broad bond funds, like Vanguard Total Bond Market ETF , which invests in fixed income securities. There’s much to learn and determine before you even get to placing your first trade. Always remember that stock trading is a risky business where your money is always at stake.

Teens can invest in stocks and ETFs, and the account includes a debit card for easy spending. Stock trading for teens has the same potential as for adults. It might look a little different, though, depending on how teens own the account. If your teen wants to handle investments, you’ll need a joint or regular brokerage account.

How Stock Trading Works

Invest only the amount of money you can afford to lose. “If all of your money’s in one stock, you could potentially lose 50% of it overnight,” Moore says. She is a thought leader in content diversity, equity and inclusion, and finds ways to make every piece of content conversational and accessible to all. The commercialisation of services and the acquisition of clients can only be carried out in Spain by an authorised entity or through a tied agent.

Some investment apps offer an option for parents to own a regular account and give teens an offshoot account, too, putting them in control. When the price of the shorted stock falls, you can buy it back at a cheaper price than you sold it for. But if the stock price increases, you still have to buy the stock to close their position, and you will lose money. For example, trading options exposes you to greater volatility. These are riskier moves, allowing you to make both gains and losses more quickly. Beginners should stick with simple buy and sell trades.

By buying an ETF or mutual fund, your portfolio is better diversified than if you owned shares of just one or two stocks; thus, you are taking on less risk overall. This is the primary advantage of buying ETFs and mutual funds over trading individual shares. Once a company has its shares listed on an exchange, anyone, including you and me, can use an online broker account to trade shares. Whether you are an everyday investor or an institutional hedge fund managing hundreds of millions of dollars in client money, anyone can trade. A stock market is a marketplace that allows investors and publicly traded companies to safely buy and sell stock. Stock markets facilitate raising capital and increasing investors’ liquidity.

If the strategy exposes you to too much risk, you need to alter it in some way to reduce the risk. There are many candlestick setups a day trader can look for to find an entry point. If followed properly, the doji reversal pattern is one of the most reliable ones. Limit orders can help you trade with more precision and confidence because you set the price at which your order should be executed. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position.

Automated, recurring stock purchases that use dollar-cost averaging help you sidestep the challenge and make investing routine. If you’re not sure where to begin, see our recommendations for the best stock trading apps. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

However, they won’t help you survive your first year as a trader. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.