How to Enter a Refund in QuickBooks Desktop?

Contents:

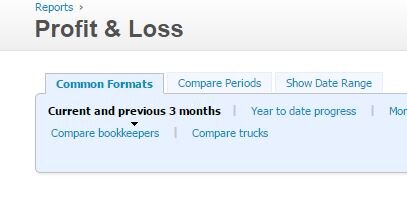

Then from the ‘Vendors’ column select the ‘Expenses’ option. Click on the downward arrow on the side of ‘Save and new’ and select the ‘Save and close’ option. From the Amount field, enter the amount of the refund. Go to the Account field, and select a Wash account. Go to the Amount field, and enter the amount of the refund. From the Credit Amount field, enter the amount of the refund.

Go to the make deposits window and click on received from the drop-down and choose the’Vendor‘ who sent you the refund. Firstly, you need to record the deposit that comes to your account. Secondly, you will have to update the bill credit section. Thirdly, you need to link both deposit and bill credit details for finally updating the database.

For this, again open the menu of “Vendors”. Now, we will record the bill credit for your amount of refund. Last week you properly went to Pay Bills. There you paid that bill and any others that needed to be paid.

We recommend making any necessary corrections to the original input screen, which you can open by clicking the Edit button under the transaction. When you are satisfied with your review or corrections, click the Save button. We suggest you follow along in your own account, so if you don’t have one, choose from a 30-day free trial or 50% off for three months. These are the most reliable methods through which you can record QuickBooks Vendor Refund. We truly believe that these steps would make the process simpler.

To record the refund or its refund check in QuickBooks Desktop and QuickBooks Online, you can apply several methods. These methods will depend on the situations and forms in which the refund/refund check was given to you by the vendor. Usually, the Banking menu or +New option can be used for initiating these methods.

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

On the other hand, a vendor credit is used to track and record refunds or credits issued to the owner by the vendor or supplier. Toapply vendor credit to a customer invoice, go to theCustomermenu, and then click onReceive Payments. Next, select the invoice you want the credits to be added to.

Convert Xero To QuickBooks Online – Complete Conversion Guide

In the Item details, select the items that you returned to the vendor. Enter the issue date of the credit document/refund check. From the Credit Card drop-down, select the credit card account. For Example rebates, reward incentives, refunds, reimbursements, or checks issued by vendors to cash out an existing credit. The next step for you is to understand the procedure for recording a vendor refund in QuickBooks online. Select ‘Set credits‘ and apply for the bill credit you created earlier then click done.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-all.jpg

Go to the “https://bookkeeping-reviews.com/ing” menu and press the “Make Deposits” option, from there. Get the “Pay Bills” option from the Vendor’s menu. In the “Amount field,” enter the amount you want to remove from your total. You need to insert the accounts on the native bill.

How to Set Up E-File in QuickBooks?

You’ve just learned how to enter a credit card refund in QuickBooks Online. The next guide in our training course is how to reconcile credit card accounts. We’ll also show you how to find the credit in the register, review the details, and make changes if needed. The vendor’s menu option requires you to select the “enter bills” button.. Your screen will prompt an error if the available vendor credits are less than the amount entered.

QuickBooks refund from vendors takes place for a number of reasons. As you run your business, you will pay for multiple supplies and continue with business as usual. However, one day the check you wrote the vendor may come back for reasons like price change and unknown discount, among others.

The blog has guided you about the become a xero advisors to record a refund from a vendor in QuickBooks online and also the procedure to record a refund in QuickBooks. On the other hand, the steps you’ve done are correct in recording vendor refunds. Also, you’ve already applied for the credit from the vendor when you select theCreditoption in thePay billswindow. I overpaid a vendor by $80 and they sent back a check for the $80.

Let us explore more such scenarios and the methods suitable for these to record the vendor refund checks. You should enter a credit card refund as soon as you determine a purchase was damaged or unnecessary. The vendor will usually process the return using the same credit card you used to make the purchase.

Is it okay to not select any item for the refund from the vendor?

In the Desktop version of QuickBooks, to find how to record refunds from vendors, you can go through the method added in this section. It will be essential to know that this method will work only when the refund has been received as credit card credit. It sounds like the vendor credit/refund process is what you are looking for. It would allow you to record vendor credits and any refunds related to them.

Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on “next,” which shows your file data. After that, apply the filters, select the fields, and then do the export. In QuickBooks, When a refund is done from a vendor then it is known as the Vendor credit. When you get this vendor credit then you have to record a refund from a vendor credit in QuickBooks Desktop. So to record this vendor credit in QuickBooks, you have to initiate a process that helps you to create its record.

Must fill out the field of date, expense account, and amount. Next in the ‘Add CC expense’, drop-down menu select ‘CC Credit’. Select the credit card from the list and then click on the ‘view register’ on right. Expense window in QuickBooks OnlineThis is the whole procedure to record a refund from a vendor in QuickBooks Online. In the ‘Add new deposit’ section fill all the required fields.

Quick Tips Thursday-Invoicing Hello Community! Are you struggling to get customers to pay you on time, or… Please add your details to this thread and I’ll get back to you. Thanks for getting back to this thread. Upon replicating the steps, the workaround shared above works on my end.

It’s not uncommon for business owners to receive refunds from vendors. There are a few different scenarios in which a vendor may issue a refund. If you accidentally paid the same bill twice, or overpaid a single bill, the vendor may issue you a refund. Another instance in which a vendor may issue a refund is if he or she is out of the product you purchased. Regardless, it’s important to record these refunds in your Quickbooks account. To delete vendor credit in Quickbooks, open the Expensemenu and theVendorstab.

Step 4: Record a credit card refund in QuickBooks Online

Last step, go to pay bills and find the vendor. Then in from account field, here you put accounts payable. Memo and amount as usual then save and close. Next you need to enter a bill credit from the bills screen. Vendor refunds are a lot more complicated to record, as most of the work has to be done manually by the user.

Then select the downloaded transaction, and choose the category refund. A refund can be easily categorized from the downloaded transaction list. Follow the procedure to categorize the refunds in QuickBooks.

You can record a vendor refund in Quickbooks Desktop using the Banking menu when it has been received as a bill. When the refund is given to you for the returned items of inventory, you can use Make Deposits given in the same menu. In one of the scenarios, you can receive a refund check that may not necessarily relate to your existing bill.